travel nurse tax home reddit

Since travel nurses are working away from their tax home certain companies must legally provide stipends andor reimbursements for their work more on this below. Yes you may lose 4000 to 6000 in tax savings a year but the cost and time of maintaining your tax home may exceed that amount.

Travel Nurses Find It Hard To Match The Salaries They Got On The Road Shots Health News Npr

My wife stopped working when we had our son who is now 10 months old.

. You may have heard your travel position has to be at least 50 miles away from your permanent residence in order to collect the tax-free stipends of. While working as a travel nurse adds an additional layer of tax challenges it can also be a great way to gain a tax advantage. CLICK ON A LINK BELOW TO LEARN MORE.

In this article well discuss all of this topics angles so travel nurses can approach it with confidence. Start your Tax Return. You maintain living expenses at.

Dont live your life around a tax deduction. Consult a tax accountant who specializes in travel nursing. VBRO is committed to user safety and comfort.

Im leaving the old job. Instead of looking at the primary place of incomebusiness it allows the tax home to default fall back on the permanent residence. Some agencies pay higher taxable wages and proportionally lower non-taxable reimbursements.

A tax home is your place of residence that you maintain and pay for while you are out on your travel assignment. We represent clients before the IRS Canadian Revenue Agency and state tax agencies in audits and resolutions. Can you Airbnb your tax home while youre away on an assignment.

I tripled my income once I started traveling and obviously am now in a higher income bracket. If not then youre not really a travel nurse and you didnt establish a tax home in Florida even if you have a multistate nursing license. Keep in mind that there are some key responsibilities and duties that come with all of these deductions.

Travel Nursing Tax-Free Stipends and Permanent Tax Homes. Establishing a Tax Home. Not just at tax time.

You will probably not make much money if you dont have a tax home. Schedule a Tax Home Consult. Indeed travel nursing brings tremendous tax benefits that can make a huge difference on your tax return.

Of course this leads to controversy. Wanted to make sure the new job would qualify as a new area since Id be in California more than 12 months. VBRO is a very trusted housing site for travel nurses.

To accomplish this many recruiters and travel nurses will rely on a ball-park tax rate figure. Travel nurses typically receive tax-free reimbursements for various expenses because they travel for work away from their tax-home. TravelTax specializes in preparing taxes for mobile professionals in healthcare IT engineering nuclear Canadian international foreign missionaries and everybody else.

However if you are going to work at a summer camp then the wonderful thing is that your housing and food presuming you live at the camp and eat at the camp wont be taxed -- youll just have a lower. Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax reimbursement payments in a typical year of work as a travel nurse. The site offers short and long-term home apartment or condo options.

If you claim a false tax home like your parents house as one recruiter suggested to me you could get fined so much money. For true travelers as defined above the tax rules allow an exception to the tax home definition. They assert that lower taxable wages will result in a red flag with the IRS.

You can review this four part series 1 2 3 4 for detailed information on how to accomplish this. Renting out tax home. Wanted to say how much I appreciate all of you.

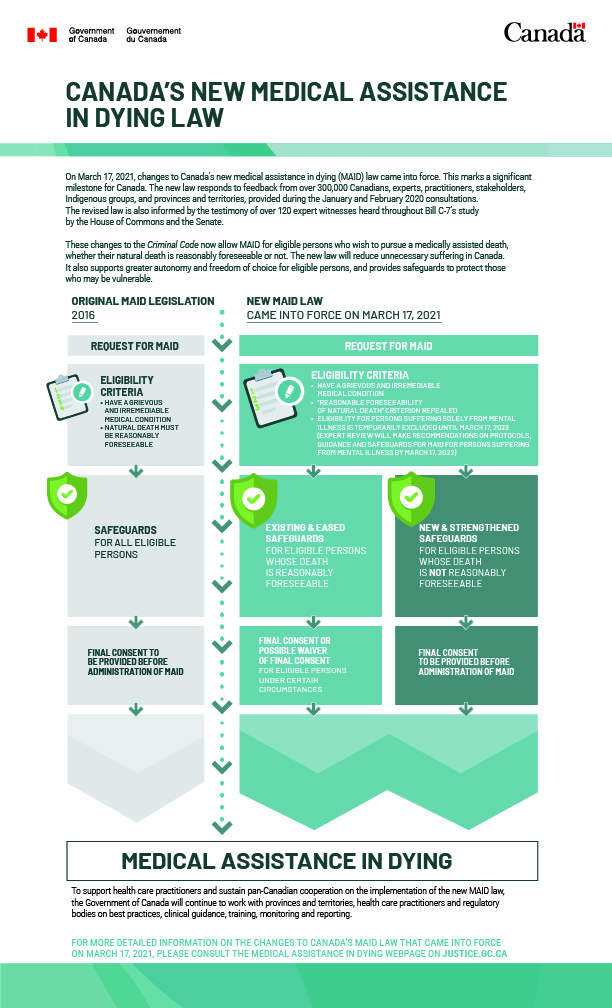

Dont get too excited yet though. With the continuation of the COVID-19 pandemic travel nurses are up against some unique challenges in 2022. First travel nurses should consider the possibility of establishing and maintaining a tax-home so that they can qualify to receive the tax-free stipends.

Last year I claimed 0 dependents and. If maintaining your tax home is too much work and you prefer to go from assignment to assignment without returning home do it. Still paying mortgage and all utilities and duplicating expenses while traveling.

Ideally the IRS would like a travel nurse to take an assignment somewhere and then return to their tax home where they maintain a PRN or full-time nursing job. While higher earning potential in addition to tax advantages are a no. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable.

Now that we have made the distinction between indefinite work and temporary work and we have discussed how to maintain temporary status as a travel nurse we can move on to our discussion about how to maintain a legitimate tax home. However there are limits as to how long a travel nurse can stay in one place and continue to qualify for tax-free reimbursements. I assume that those who believe they dont have a tax-home are harboring this belief because.

Travel Nursing Pay Qualifying for Tax-Free Stipends. For example they might estimate that the tax burden will be 20. I have been travel nursing for about 19 months now.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. See Travel Nurse Tax Deductions to Take Advantage of this Tax Season. They protect your payment against fraud and a dedicated care.

One of the most common myths about travel nursing is you have to travel across the country or even work out of state. The new travel job is 13 weeks but could be extended. The guidelines pertaining to taxable wages in the travel nursing industry are opaque.

I could spend a long time on this but here is the 3-sentence definition. Been there for 11 months. Tax Recommendations for Travel Nurses.

The IRS requires that travel nurses satisfy three requirements to maintain a tax home and save on tax deductible expenses. The 3 Factor Threshold Test. You work as a travel nurse in the area of your permanent residence and live there while youre working.

Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem reimbursement are all factors to consider when understanding your travel nursing pay and taxes. This is the most common Tax Questions of Travel Nurses we receive all year. They will then multiply the gross weekly taxable wage by 20 to determine the estimated tax burden.

1 A tax home is your main area not state of work. I would like my tax home in another state since taxes are so high in CA and who doesnt like tax free money. Other agencies pay lower taxable wages and proportionally higher non-taxable.

For this to apply however the travel nurse must meet 2 out of 3 of the following criteria. I cant tell you the number of travel nurses I meet who have no understanding of a tax home.

Woman Learns Of Mother S Death At Ont Nursing Home With Covid 19 Outbreak From Outside Window Ctv News

Canada S New Medical Assistance In Dying Maid Law

U S Travel Nurses Are Being Offered As Much As 8 000 A Week Bnn Bloomberg

Message From The Acting Chief Of Military Personnel On Diversity Inclusion And Culture Change Short Term Initiatives Canada Ca

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca

Inspection Report Nursing Home Where Nearly All Residents Have Covid 19 Caused Actual Harm Ctv News

Travel Nurses Find It Hard To Match The Salaries They Got On The Road Shots Health News Npr

Trusted Guide To Travel Nurse Taxes Trusted Health

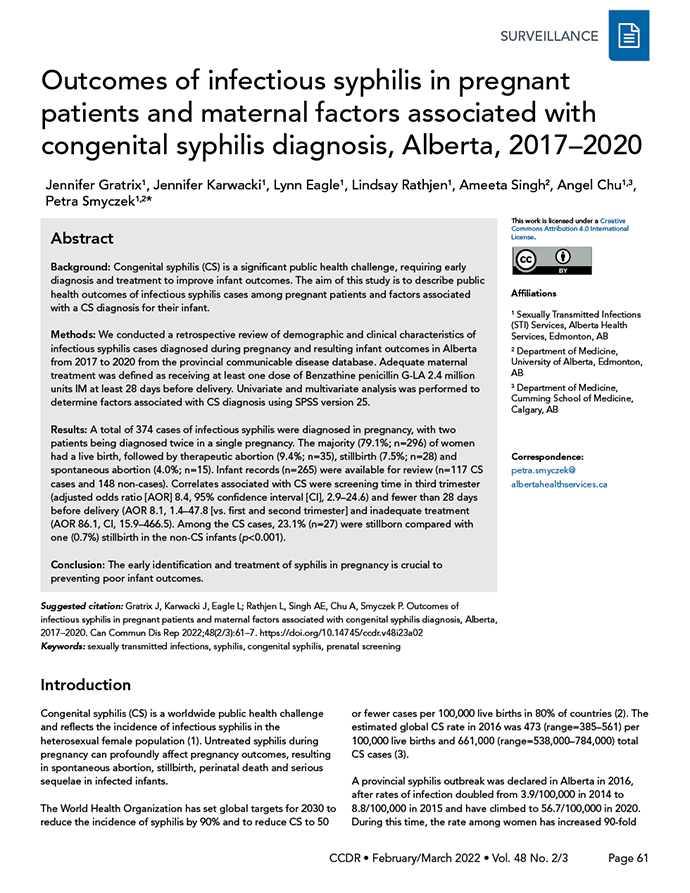

Outcomes Of Infectious Syphilis In Pregnant Patients And Maternal Factors Associated With Congenital Syphilis Diagnosis Alberta 2017 2020 Ccdr 48 2 3 Canada Ca

Chapter 5 Postpartum Care Canada Ca

Travel Nursing Is Great But Don T Forget Your Tax Home R Nursing

What Is An Average Housing Stipend For A Travel Nurse Trusted Nurse Staffing

Reddit S Anti Work Subreddit Temporarily Shuts Down After An Awkward Interview Between A Moderator And Fox News Host Jesse Watters

The Pros And Cons Of Travel Nursing Bluepipes Blog

To Protect Frontline Workers During And After Covid 19 We Must Define Who They Are

Hospitals To Lean On More Expensive Travel Nurses Even After Covid Bnn Bloomberg

University Of Regina Program Trains Francophone Nurses

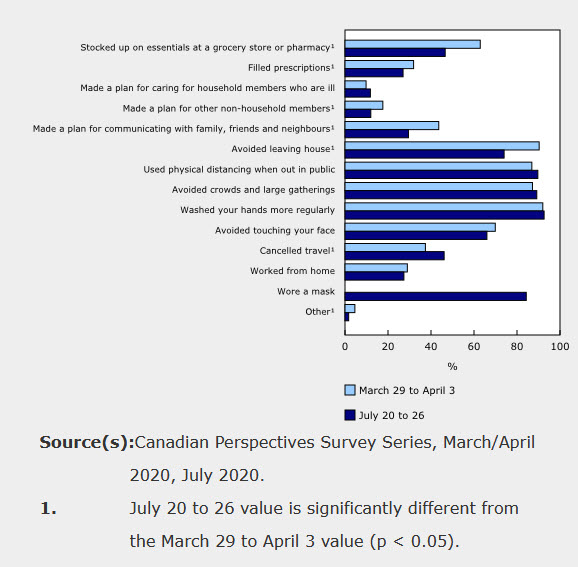

Covid 19 In Canada A Six Month Update On Social And Economic Impacts

What Is An Average Housing Stipend For A Travel Nurse Trusted Nurse Staffing